Health Savings Account (HSA)

monetization_on Financial Well-Being

What is a Health Savings Account(HSA)?

Did you know the Anthem Advantage Medical Plan with HSA uses the same network providers as the Anthem PPO Medical Plan?

Other than the Advantage Plan’s lower per pay period contributions and lower annual out-of-pocket max, the primary difference is how you pay for eligible medical expenses such as the deductible, co-insurance, prescriptions, etc. Here’s a full list of eligible medical expenses you may pay for with HSA funds.

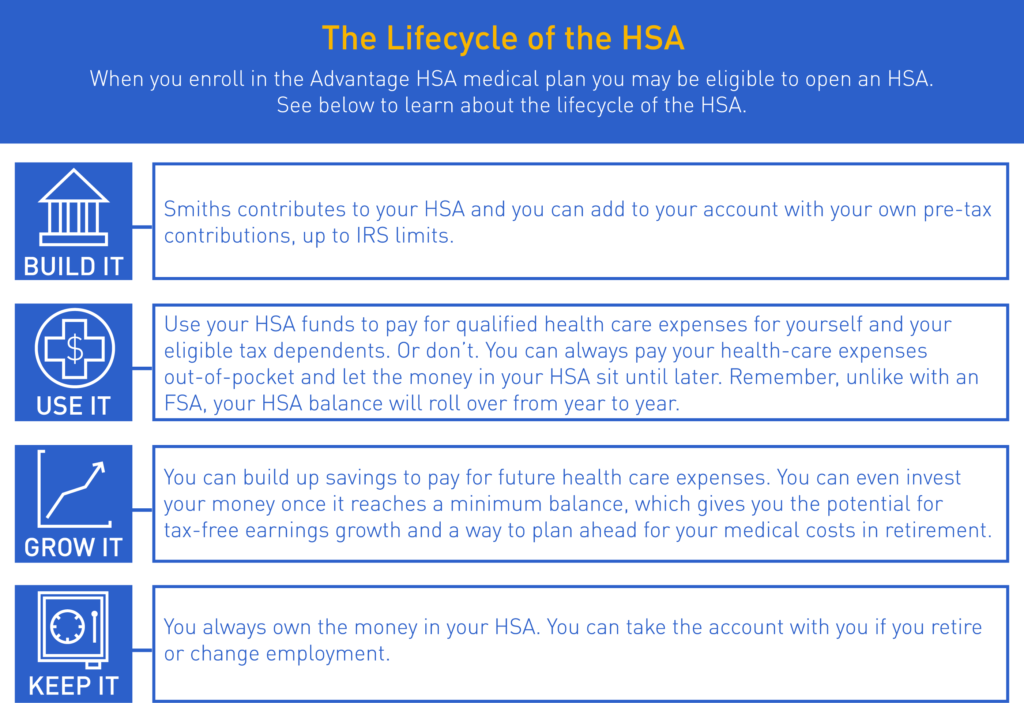

If you qualify to make/receive HSA contributions you may open an HSA when enrolling in the Advantage plan. Consider the HSA as part of your retirement savings strategy. Your HSA balance grows over time through contributions as well as investments (if you choose to invest) and interest earnings—all tax-free. While you are not required to contribute to an HSA, more than half of Smiths Group employees have already enrolled.

Tax Advantages – the “triple-tax advantage”:

- Money is set aside from your paycheck before taxes

- All withdrawals used to pay for qualified expenses are untaxed

- Anything your HSA dollars earn through interest or investing is tax-free

The account and balance stay with you, it’s your health savings account!